Alternative investment

Infrastructure and real estate investment

The company is committed to supporting major national projects as well as social and economic sustainability while delivering satisfactory returns to investors by participating in investments in infrastructure (transportation, energy, utilities, environmental protection, telecom, etc.) and real estate through corresponding investment plans.

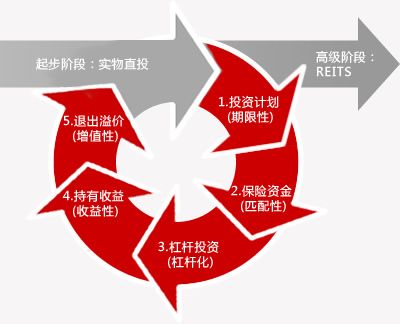

Characteristics of the business

The investment needs of insurance funds are perfectly matched by the financing needs of infrastructure and real estate projects, which offer natural cooperation opportunities for the investment of insurance funds.

Taikang Asset is an ideal bridge to connect insurance funds with infrastructure and real estate projects.

Most companies finance their infrastructure and real estate projects through fixed asset loans or enterprise bonds. However, fixed asset loans are costly with short maturities and limited options in terms of the form and structure of interest rate; to issue enterprise bonds, companies must go through cumbersome procedures, and there is often a cap on the amount of borrowing. Therefore, their diverse financing needs can hardly be met by the two channels.

Strengths of the business

Availability of large funds

With the support of its shareholder Taikang Insurance Group, the company can organize multiple insurance companies to collectively invest billions or even tens of billions in a single project to satisfy the large funding needs of infrastructure and real estate projects.

Flexible investment horizon

Life insurance premiums are long-term liabilities for insurance companies. When investing, we deliberately opt for a long-term investment horizon that well matches the long payback period of infrastructure and real estate projects. We can also raise funds from property insurance companies whose premiums are short-term liabilities to satisfy the short-term funding needs of project owners. Therefore, the term structures of debt plans can be flexibly customized according to project needs. The maturity can be as short as one year or as long as ten years to meet the diverse maturity needs of projects.

Diverse forms of investment

An investment plan is an individualized product whose form of investment can be very flexible. We offer a variety of repayment options such as fixed interest rate, floating interest rate, periodic installments and lump-sum repayment. We also customize the transaction structure based on the unique funding needs of different project owners.

Low financing cost

The interest rates of debt plans are usually lower than the interest rates of bank loans, which can help project owners reduce financial costs.

Financial investor

As a financial investor, we expect long-term partnerships with infrastructure and real estate project investors and operators for strategic mutual benefits.

Long-term investor

Insurance companies are mostly long-term investors when making equity investments and will not exit in a short period of time. They are not only less demanding of invested projects’ cash flows, but can also leverage their strengths in growing cash flows, diversified investment formats and extensive capital market experience to satisfy the long-term funding needs and maximize the value of invested projects and companies.

Emphasis on stable returns

Given the characteristics of insurance funds, we don't seek short-term high returns, but pursue, with controllable risks, stable and reasonable returns on investments over a long-term horizon.

Areas of investment

Infrastructure investment

Target sectors

Transportation, energy, utilities, environmental protection and telecom, etc.

Forms of investment

Debt investment: offer repayment options such as fixed interest rate, floating interest rate, periodic installments and lump-sum repayment, etc.

Equity investment: emphasize the long-term value of equities and may arrange deals innovatively based on individualized financing needs.

Innovative investment: may design a hybrid “equity plus debt” investment model based on specific business needs.

Real estate investment

Target properties

Office buildings: class-A office buildings in the core areas of tier-1 cities

Retail buildings: shopping malls and mixed-use real estate projects located in economically developed areas that can generate stable rents

Hotels: brand hotels located in the core areas of tier-1 cities

Industrial properties: industrial parks that are operated by large central enterprises and encouraged by national industrial policies.

Forms of investment

Debt investment: offer repayment options such as fixed interest rate, floating interest rate, period installments and one lump-sum repayment.

Equity investment: emphasize the long-term value of equities and may arrange deals innovatively based on individualized financing needs.

Property investment: target highly liquid properties and may adopt two ways: property transaction and equity transaction.

Innovative investment: may design a hybrid “equity plus debt” investment model based on specific business needs.

Financial product investment

Trust products, bank wealth management products and securities firm specific asset investment plans

Cooperate with us

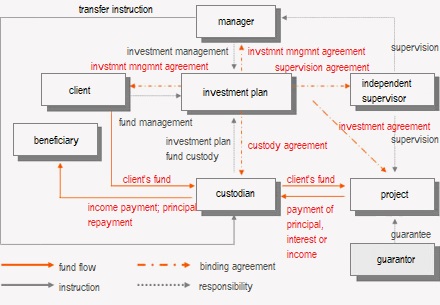

Structure of cooperation—debt

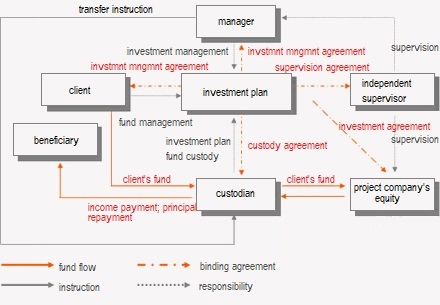

Structure of cooperation—equity

Structure of cooperation—property

Selected projects

| Date | Project | Funds raised | Type |

|---|

|

||||

|

||||

|

||||

|

||||

|

||||

|

Equity investment

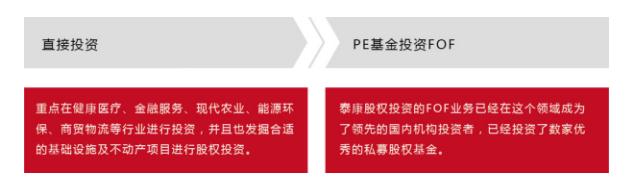

Taikang’s equity investment is focused on two businesses: the first is to participate in or control the equity or similar assets of qualified companies; the second is to make FOF investments.

Milestones

2017

April: Beijing Taikang Investment Co., Ltd. (Taikang Investment) was ranked among the top 5 insurer-owned institutional investors in 2016.

May: The phase-1 industrial development fund of Shandong Guokong Taikang completed the fund raising and registration. The fund was jointly created by Beijing Taikang Investment Co., Ltd. and subsidiaries of Shandong State-owned Assets Investment Holding Co., Ltd., which will mainly invest in healthcare and consumer sectors as well as SOE reforms in Shandong province.

2016年

February: Taikang invested in Meituan Dianping, which is a one-stop leading platform in providing retail and online group buying services with more than 200 product categories. It has received nearly one billion user reviews and operates in thousands of cities in China.

March: The Taikang-Shandong High-speed Group Urbanization and Infrastructure Fund, which is an equity investment plan, was launched with a capital of RMB 12 billion. The project was approved by the State-owned Assets Supervision and Administration Commission of Shandong Province and is designed to support the national Belt and Road initiative. It was co-created with a large local SOE, Shandong High-speed Group and was later renamed Shandong High-speed Urbanization Investment Fund. The fund mainly targets expressway construction, nuclear power, urban renewal and other infrastructure projects. As a win-win partnership between a local government and an insurance company, the fund can not only support local economic growth, but will also generate stable returns for insurance funds.

April: Taikang and CITICPE worked together to privatize Biosensors, a medical device company listed on the Singapore Exchange. As the world’s 4th largest DES manufacturer, Biosensors is specialized in the R&D and manufacturing of products used for minimally invasive cardiac surgery.

April: Taikang bought from Hersha Hospitality Trust a portfolio of seven hotels, five of which are located in Midtown Manhattan and two in Downtown Manhattan, two areas that boast high densities of office buildings and large inflows of visitors. The seven hotels, which are all premium limited service hotels, are managed by Hilton and Intercontinental. With their occupancy rates stabilized above 90%, the portfolio generates good returns.

May: Taikang invested in Fenqile (now renamed Lexin Fintech Holdings), the largest online consumer finance platform in China. It is driven by an innovative business model that connects the Internet, micro-finance and consumer context, which allows the company to possess a large wealth of quality micro-credit assets. Fenqile was among the first group of Chinese start-ups to issue asset-backed securities (ABS) and has forged substantial business relationships with many insurance companies and commercial banks. It has created a financial ecosystem that connects quality online credit needs and various kinds of traditional financial institutions.

June: Taikang increased its investment as the biggest shareholder of Hanxi Putai, a company focused on the development of chain hospitals specialized in cardiology and derivative businesses.

June: Poly Real Estate announced that Taikang purchased 6.18% of its outstanding shares with an investment of RMB 6 billion worth of insurance funds through a private placement program. Combined with its current position, Taikang and other accounts managed by Taikang Asset held a total of 7.35% of the outstanding shares of the company, making it the 2nd largest shareholder.

July: Taikang purchased from CBRE a portfolio of logistics properties located in Japan. The portfolio is comprised of 169 properties spread across Japan, with 33 located in major cities and 136 located in regional cities. The joint venture formed by Daimler Trucks and Mitsubishi is the sole tenant of these properties with long-term leases. The portfolio generates a stable stream of cash income with a high internal rate of return.

July: Taikang invested in Didi Chuxing, the world’s largest mobile transportation platform. The company serves hundreds of millions of consumers through its global network of partners and businesses ranging from taxi, premier, express, hitch, designated driving and bus services. Its merger with Uber China in August 2016 further consolidated the company’s absolute dominance in the shared transportation market and has since distanced itself further from other market participants.

July: Sotheby’s announced Taikang as its biggest shareholder after the latter’s purchase of shares from the US secondary market for USD 233 million.

September: Taikang became the 2nd largest shareholder of China Merchants Expressway when the latter reorganized China Merchants Huajian Highway Investment Co., Ltd. and brought in strategic investors. In November, North China Expressway, controlled by China Merchants Expressway, disclosed in an announcement that the two companies would be merged and listed as a whole.

September: Taikang invested in the Phase II logistics asset package of GLP, which is comprised of 269 logistics properties spread across the US. The buildings included in the package are relatively new with high occupancy rates. Tenants include many famous retailers and manufacturers such as Amazon, Home Depot and Hanesbrands. Managed by GLP, the package is a stable source of cash income and promises much room for appreciation.

October: Taikang invested in Sichuan Hefu Medical Corporation, a privately owned company specialized in specialty hospital management, and became the biggest shareholder next only to its actual controlling person.

November: Taikang announced an investment of RMB 1.1 billion for a 26.44% stake in Harmonicare Medical, a company that was founded in 2003 and launched its IPO in Hong Kong in 2015. The investment elevated Taikang as the 2nd largest shareholder of the company, the largest chain of women and children hospitals in China.

November: Taikang announced to invest RMB 1.1 billion in ParkwayHealth China, a subsidiary of IHH, which is Asia’s 1st and the world’s 2nd largest hospital group by market capitalization. As a wholly owned subsidiary of IHH, ParkwayHealth China operates hospitals and clinics in China. It is one of the largest foreign-invested healthcare institutions that has served the medium-to-high range of China’s healthcare market for over ten years.

November: Taikang invested in Mindray, which is China’s largest and a global leader provider of medical devices and solutions.

December: Beijing Taikang Investment Co., Ltd. (Taikang Investment) was registered with the Asset Management Association of China as a PE fund manager. Licensed by the China Insurance Regulatory Commission as a qualified equity investment manager, Taikang Investment will partner with local state-owned assets holding companies to establish industrial development funds. This will allow Taikang to capitalize on local quality resources and strengths, while supporting SOE reforms. The company will also invest in healthcare and consumer sectors, leveraging its strengths in funding and innovating the use of funds. It will also help SOEs connect with capital markets to improve asset securitization and reap dividends from reforms. In the future, Taikang Asset will continue to launch alternative equity funds onshore and offshore.

December: Taikang entered into an investment agreement with MXB Biotechnologies. The company is China’s 2nd largest provider of IHC detection reagents for cancer, manufacturing over 200 kinds of detection reagents and providing products and services to over 2,000 tertiary and secondary hospitals.

December: Taikang entered into an investment agreement with Innovent Biologics, Inc., which is one of the most promising biopharmaceutical companies in China that is specialized in the R&D and production of monoclonal antibodies.

December: Taikang invested in Wuxi AppTech, which is a leading comprehensive capability and technology platform in the global pharmaceutical and healthcare industry, serving sectors ranging from pharmaceuticals to biotechnology, medical devices and public health.

2015

January: SDIC Trust announced to bring in Taikang Life and Taikang Asset as strategic investors and renamed itself “SDIC Taikang Trust”. Taikang Life and Taikang Asset holds a combined 35% stake, which marks Taikang’s first deal in China’s mixed-ownership reform of SOEs.

October: Taikang led a USD 220-million investment in the series C funding of Womai, followed by Baidu, Dragon Capital and Riverhead Capital.

2013

June: Taikang Asset led several insurance companies to make an RMB 36 billion equity investment (RMB 10 billion from Taikang, or 27.8% of the total contribution by insurance companies) in the Lines 1 and 2 of PetroChina’s west pipeline project and became a shareholder of PetroChina Pipeline Union. The investment marks the historic entry of private-sector capital into China’s strategic sectors and boosts the country’s innovation in investment and financing.

2009

November: Taikang Asset was approved to launch the “Taikang—Senior Housing Equity Investment Plan”, which raised RMB 2.2 billion to build a senior housing project in Changping, Beijing. It was the first pilot project for the investment of insurance funds in real estate after the new insurance law took effect. Taikang Asset is committed to senior housing development as part of its mission to provide care from cradle to grave.

2008

June: Taikang Asset was entrusted by Taikang Life to participate in the share capital increase of China UnionPay. Taikang became a shareholder of the company as a strategic investor.

May: Taikang Asset joined hands with several other insurance companies to launch the Beijing—Shanghai High-speed Railway Equity Investment Plan, which totally raised RMB 16 billion (RMB 3 billion from Taikang, which represented 18.7% of the combined contribution by insurance companies) to own a stake in Beijing—Shanghai High-speed Railway Co., Ltd.